Arbitrage Meaning in Stock Market

Arbitrage is the simultaneous trading of currency commodities securities or other financial instruments in different markets or derivative forms. Arbitrage in its purest form is defined as the purchase of securities on one market for immediate resale on another market in order to profit from a price discrepancy.

Arbitrage Definition And Examples A Common Trading Strategy

Definition and Example of Arbitrage.

. Arbitrage is a trade where a Trader buys the stockshares security in one market and sell the same stock at same time in another market at a higher price to get the profit with zero. Arbitrage is the process of simultaneous buying and selling of an asset from different platforms exchanges or locations to cash in on the price difference usually small in percentage terms. The word arbitrage is now a part of the stock market.

The method on the stock exchange of buying something in one place and selling it in another. The method on the stock exchange of buying something in one place and selling it in another. Arbitrage is a financial process that occurs when someone sells the same asset in two different markets simultaneously one at a higher price than the other.

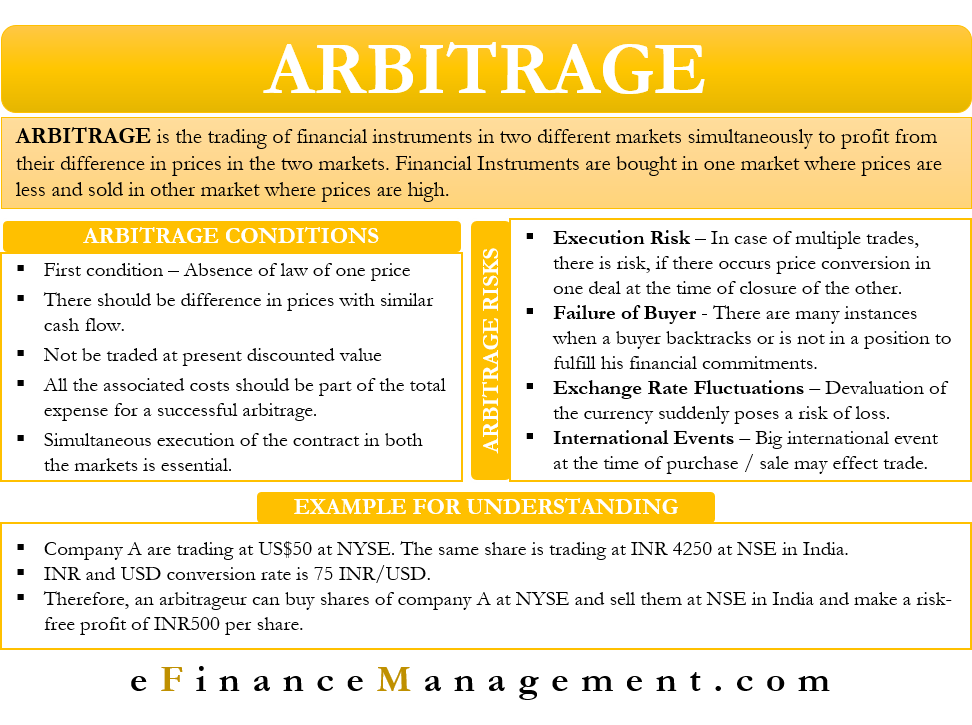

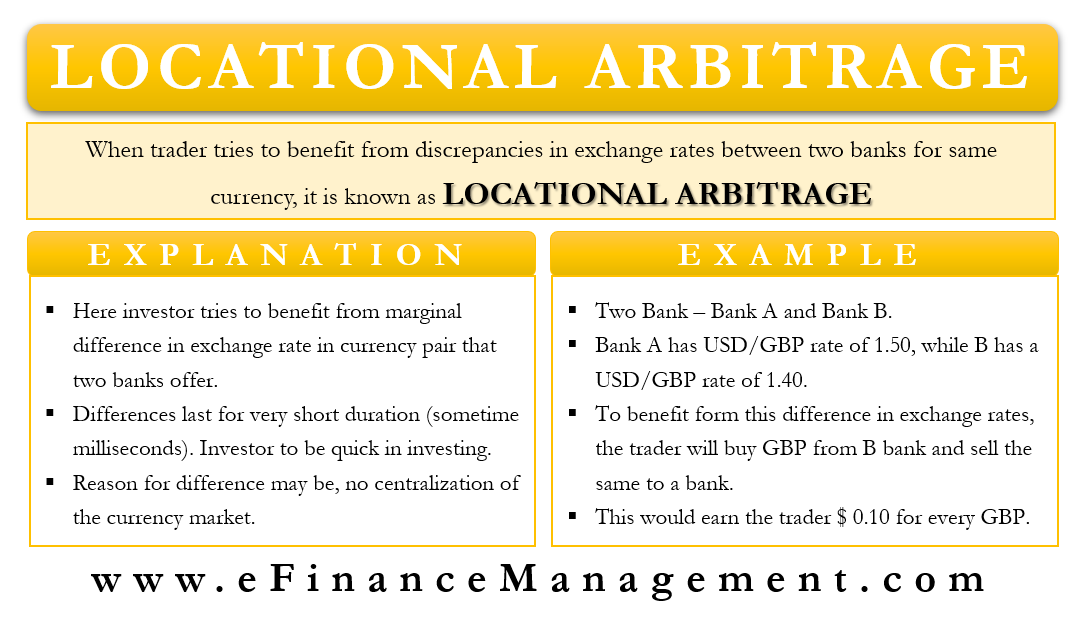

Arbitrage definition and meaning. Arbitrage is a technique of making profit on stock exchange trading through difference in prices of two different markets. Furthermore arbitrageurs also serve a useful purpose by.

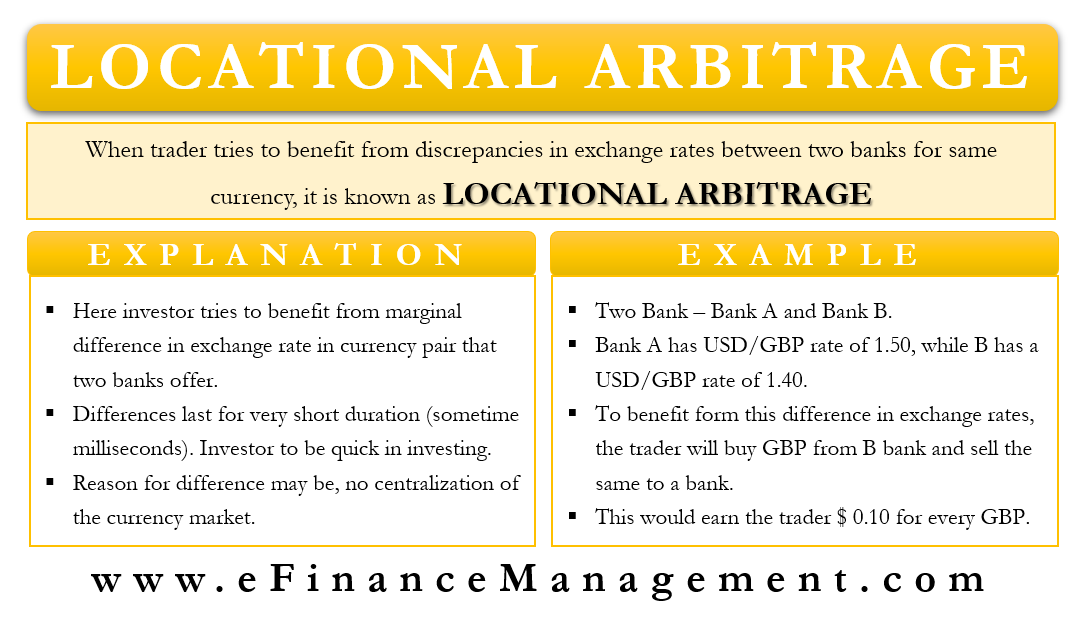

A computer program used to place simultaneous orders for stock or commodities futures and the underlying stocks or. Arbitrage is a strategy that is used for exploiting the market inefficiencies for making profits. Arbitrage is a trading strategy in which there is an attempt to profit from momentary price differences that can develop when a security or commodity trades on two.

Due to some inbuilt. To understand arbitrage meaning it is important to understand the mechanism behind arbitrage. Arbitrage is a specialized investment technique that involves the simultaneous purchase and sale of a security on different markets to profit from temporary price disparities.

An arbitrageur is a type of investor who attempts to profit from price inefficiencies in the market by making simultaneous trades that offset each other to capture risk-free profits. Arbitrage is a trading strategy whereby you simultaneously buy and sell similar securities currencies or other assets in two different. If advantages of price are taken between two markets in the same.

Arbitrage trading is not only legal in the United States but is encouraged as it contributes to market efficiency. Arbitrage Trading Program - ATP. In economics by definition from the Oxford Dictionary arbitrage meaning is the simultaneous buying and selling of.

Index arbitrage is a type of arbitrage trading that involves making a profit by. The price of an asset is the function of demand and supply.

What Is Arbitrage Trading Quora

Arbitrage Meaning Conditions For Arbitrage Risks

What Is Arbitrage Trading And How Does It Work Ig Australia

Locational Arbitrage Meaning Examples And More

0 Response to "Arbitrage Meaning in Stock Market"

Post a Comment